Animana tracks payments throughout the day. At the end of the day, it expects a specific amount on the card machine and in the cash drawer. This article will guide you in solving positive cash differences in your day overview.

If you make corrections to transactions, do not forget to adjust the time of cash count in the day overview to a minute or so later than the time the latest correction was executed.

Before you start

If you do not know how to do a cash count, read the following article first: How do I do a day-end cash count (Day Overview)?

Should you have a different error in your day overview, please read the following article: How do I correct errors in the day overview?

Reasons and solutions for positive cash differences

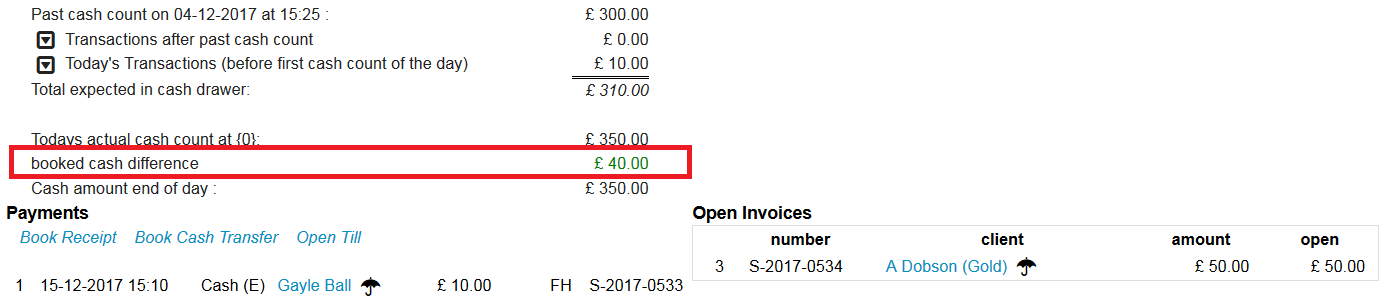

Positive cash differences are displayed in green. Cash differences under £10 are displayed in black.

Below you will find a list of possible reasons for a positive cash difference – and how to fix them.

1: A miscount or incorrect entry

Count your cash again to make sure the cash difference is not caused by a simple miscount. Also double check to make sure you entered your counted cash amount correctly.

To correct, adjust the amount(s) and click Save.

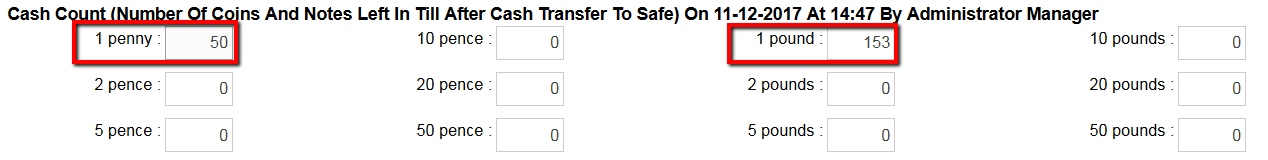

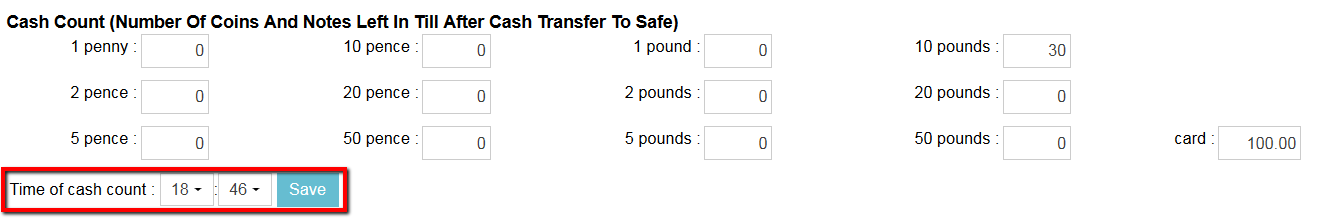

2: Time of cash count is not correct

Make sure the time of cash count is set at a time after your latest transaction, to ensure that all transactions are included in the day overview. If you have made a correction to a transaction, do not forget to adjust the time in the day overview to a minute or so later than the time the last correction was executed.

To correct, adjust the time by clicking on the hour and/or minutes and select a different time in the drop-down menu for time. Then click Save.

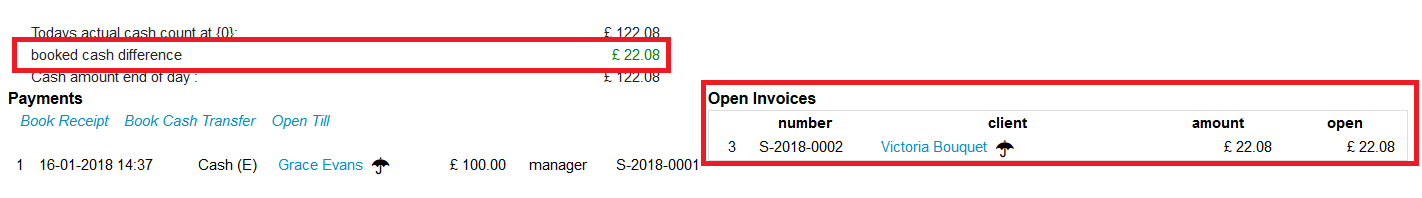

3: An invoice was created and paid but the payment wasn’t recorded

If an invoice was created and payment was made via cash but you forgot to record the payment in Animana, that invoice will be recorded as an open invoice in Animana. Therefore, the invoice will be listed in the section “Open invoices” of the day overview.

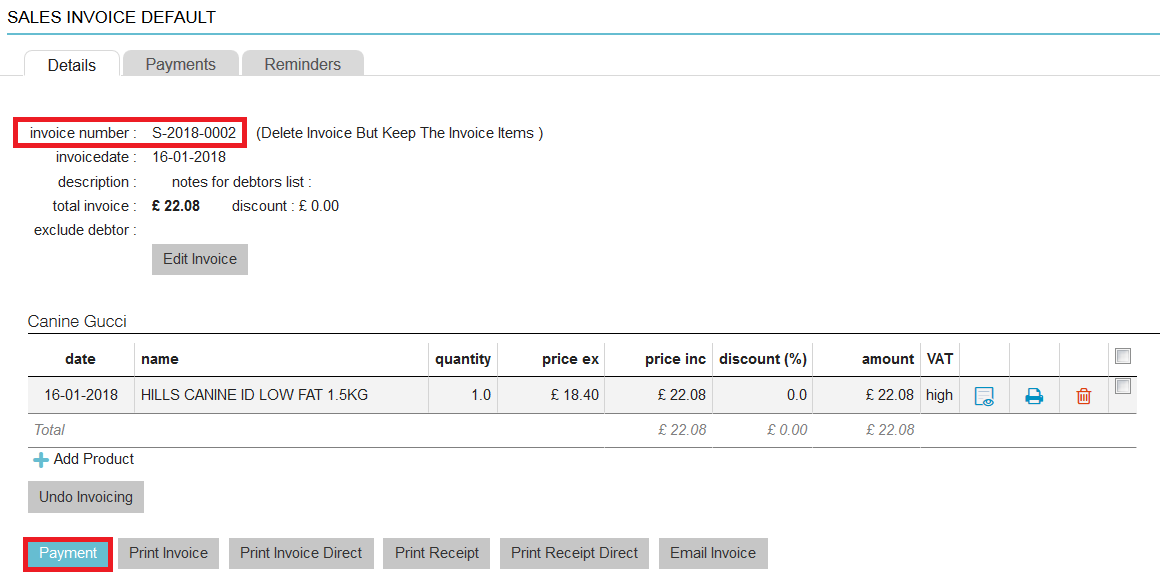

In the screenshot above, invoice S-2018-0002 for client Victoria Bouquet is recorded as an open invoice but was actually paid by cash.

To correct, proceed as follows:

- Click on the name of the client to go to their Client File.

- Click the relevant invoice to open it (in the example: invoice S-2018-0002). It will be displayed in red because the invoice has not been (fully) paid.

- Click on the button Payment.

- Make sure only the bold invoice is selected.

- Select the payment method on the right. In this example, you would choose Cash.

- Click Finish.

- In the day overview, do not forget to adjust the time of cash count and click Save again.

4: An invoice was paid by cash but was recorded as paid by a different payment method

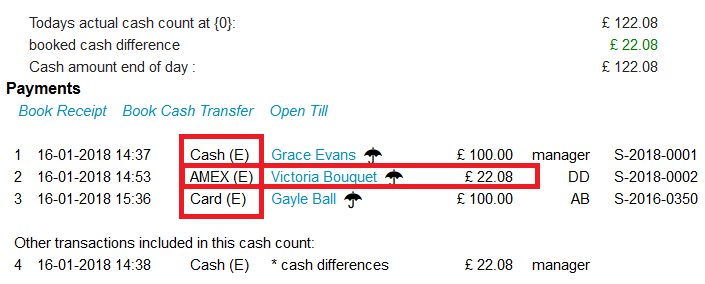

Check if there are any invoices that have a payment listed against them in the section “Payments” of the day overview with the same amount as your cash difference. Then check with your colleague who took the payment as to how the payment was received.

In the screenshot above, invoice S-2018-0002 for client Victoria Bouquet was recorded as paid by AMEX, but was actually paid by cash.

To correct, proceed as follows:

- Click on the name of the client to go to their Client File.

- Click the relevant invoice to open it (in the example: invoice S-2018-0002).

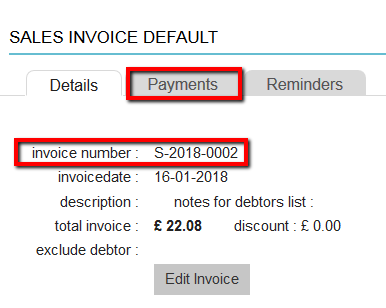

- Click on the tab Payments at the top.

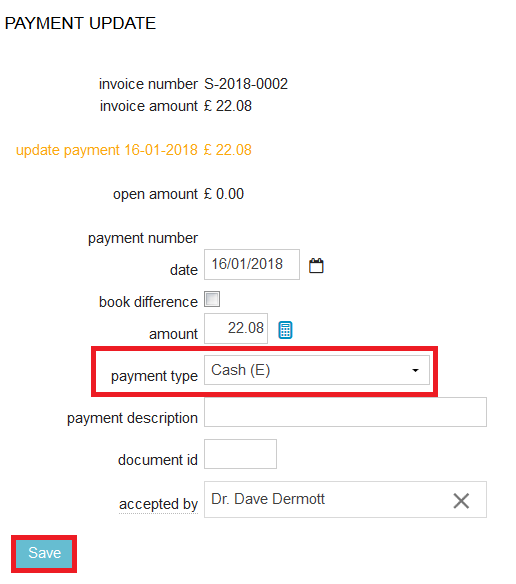

- Click the date, amount or payment type to open the payment details.

- Correct the payment type by clicking on the drop-down menu and select “cash”.

- If needed, you can also edit the other fields (payment date, amount, description, etc).

- Click Save.

- In the day overview, do not forget to adjust the time of cash count and click Save again.

5: An invoice was not created and the payment was received but not recorded

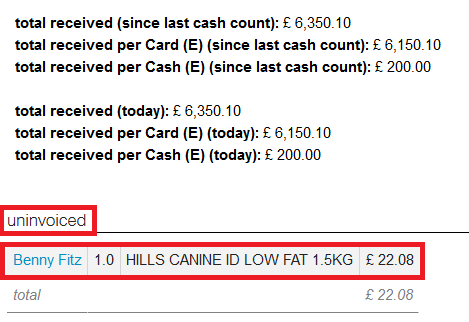

If you received a cash payment but forgot to create an invoice, and also forgot to record the payment in Animana, then you will not have an invoice number. In this case, the products added to a patient (or herd) will be listed in the section “Uninvoiced” of the day overview. This section is displayed on the bottom of the day overview page.

In the screenshot above, the bag of Hills for the cat owner Benny Fitz is recorded as uninvoiced, but was actually paid by cash.

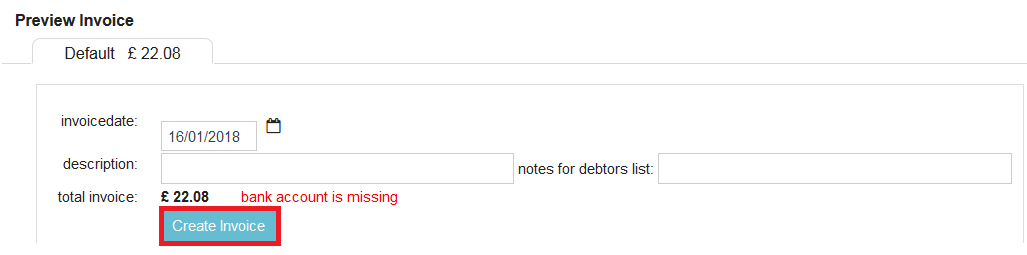

To correct, proceed as follows:

- Click on the name of the client to go to the Uninvoiced tab of this client.

- Click Create Invoice.

- Make sure only the bold invoice is selected.

- Select the payment method on the right. In this example, you would choose Cash.

- Click Finish.

- In the day overview, do not forget to adjust the time of cash count and click Save again.

6: A purchase invoice (P-invoice) or receipt was recorded as paid by cash but was actually paid differently

Purchase invoices are invoices/receipts that you receive. Sales invoices are invoices you send out to your clients. Sales invoices have the format S-YYYY-0000 (e.g. S-2018-0002). Purchase invoices have the format: P-YYYY-0000 (e.g. P-2018-0002).

When booking a receipt in the day overview you are creating a purchase invoice. And by default, receipts are paid by cash. When a purchase invoice is recorded as paid per cash but was actually paid by petty cash or a different payment option, you will have a positive cash difference at the end of the day.

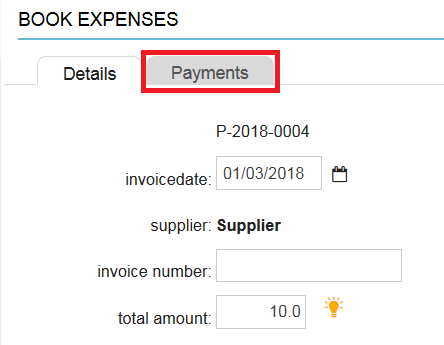

To correct, proceed as follows:

- Click on the supplier to go to the Client File.

- Click the relevant invoice to open it (in this example: invoice P-2018-0004).

- Click on the tab Payments at the top.

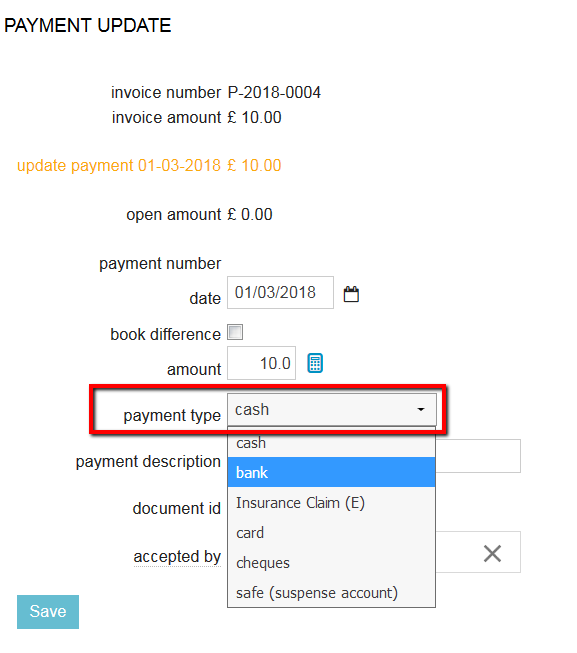

- Click on the payment to open the payment details.

- Correct the payment type by clicking on the drop-down menu and selecting the correct payment type.

- If needed, you can also edit the other fields (payment date, amount, description, etc).

- Click Save.

- In the day overview, do not forget to adjust the time of cash count and click Save again.

7: An extra amount was received in cash but not recorded

Sometimes, an extra amount is received, perhaps because your customer pays a few pennies extra to round off the invoice amount or because they pay extra as a gratuity. If you did not register this in Animana but do add the cash to your cash drawer then Animana will say there is a positive cash difference. Please consult your accountant to discuss how to process these fees.

Related articles

- How do I do a day-end cash count (Day Overview)?

- How do I correct errors in the day overview?

- How do I correct a negative card difference in the day overview?

- How do I correct a negative cash difference in the day overview?

- How do I correct a positive cash difference in the day overview?

- How do I book a receipt?

- How do I book a cash transfer?

- Add expenses

- In focus: Processing a payment