In Animana you are able to create your own ledger scheme to keep track of your financial balance, profits, and losses. This article will provide step by step instructions on how to add a new ledger.

Before you start

This is box title

- You need permission to be able to edit the ledger scheme. Permissions can be adjusted by practice administrators in

> General Settings > Role Management.

> General Settings > Role Management. - The ledger scheme in a new Animana account consists only of the necessary ledgers. Contact your bookkeeper or accountant and compare the ledger scheme in Animana with your current ledger scheme or the desired ledger scheme.

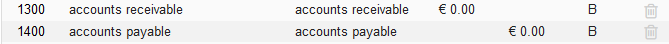

- Locked ledgers – which cannot be deleted – are system ledgers that already attached settings defined. The names and settings can not be changed. However, all numbers can be changed. Other ledgers also become locked when there are bookings on them or the start amount has been filled in. Here are some examples of locked ledgers:

Step-by-step instructions

This is box title

If there are plans to add a new ledger on or after December 1st, a new ledger needs to be created for the current year but also one for the new year.

- Browse to

> Financial > Ledger Scheme.

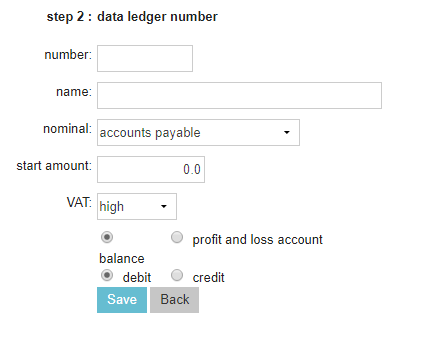

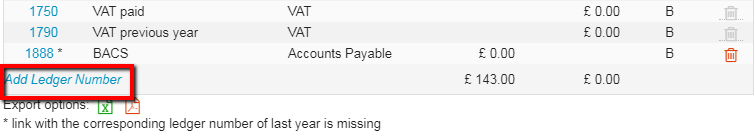

> Financial > Ledger Scheme. - The page will show two different tables. One for the “balance” and the other for “profit and loss account”. Click on the Add Ledger Number link at the bottom of one of the tables:

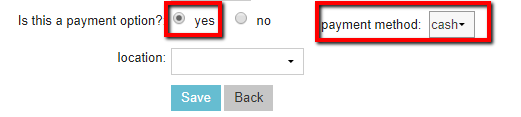

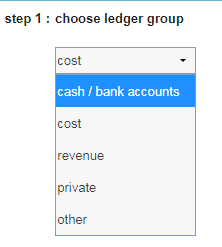

- During the first step you need to select a ledger group. From the drop down menu you have the ability to select from – cash/bank accounts, cost, revenue, private or other:

Here is an overview as to what these ledger groups mean, which should help you decide which ledger group is the correct one, after you have made your selection. Click on one of the ledger options below to see more details, and once a selection has been made, proceed to the next step.This is box titleThe ledger group setting is important since they have default settings that cannot be changed and determine where and how a ledger can be used. If you do not know which ledger group to use, please contact your accountant or bookkeeper.

Here is an overview as to what these ledger groups mean, which should help you decide which ledger group is the correct one, after you have made your selection. Click on one of the ledger options below to see more details, and once a selection has been made, proceed to the next step.This is box titleThe ledger group setting is important since they have default settings that cannot be changed and determine where and how a ledger can be used. If you do not know which ledger group to use, please contact your accountant or bookkeeper.

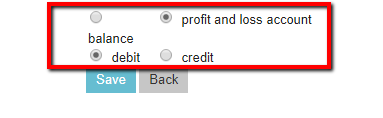

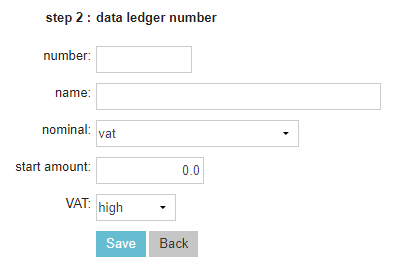

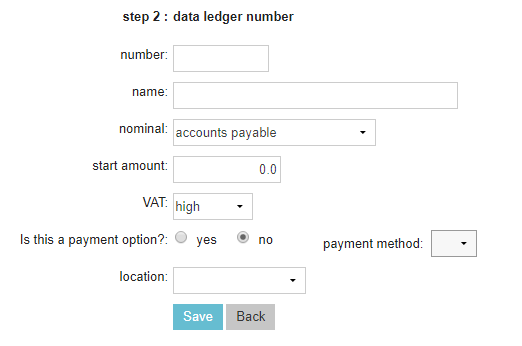

- Once you have filled in everything on the ledger, click on the Save button

More about this

How do I export the ledger scheme into Excel or PDF?

- Go to

> Financial > Ledger Scheme.

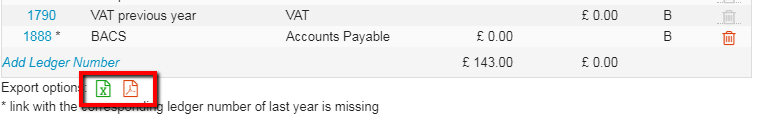

> Financial > Ledger Scheme. - Scroll down and click one of the buttons at the bottom of the table.

Press to export to Excel or press

to export to Excel or press  to export to PDF.

to export to PDF.

This is box title

The exported information will show you the information displayed on this screen.

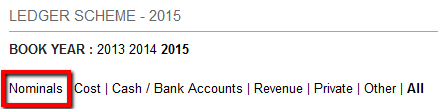

Nominals

Nominals can be added and/or changed at the top of the ledger scheme by clicking on nominals. Simply enter a name and click save. If you wish to order this list other than alphabetical you can add a number in the order field.

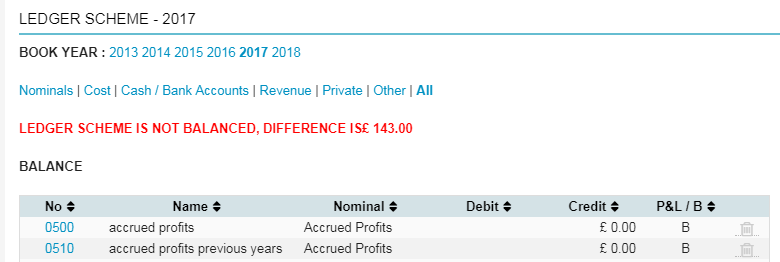

Ledger scheme not balanced

If the debit and credit amounts on the balance are not the same you will see a red warning:

This should resolve itself when all the correct start amounts have been entered.

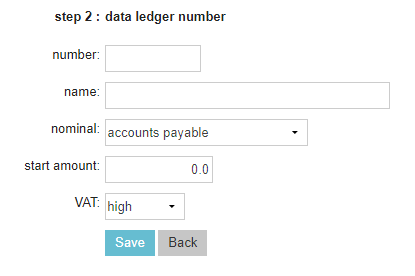

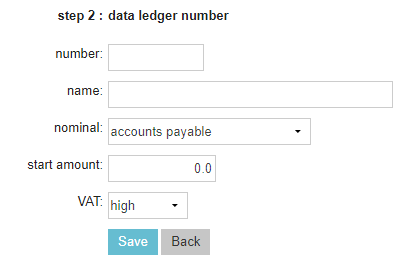

In the first field you may enter a number. Feel free to make up a number. Your accountant probably has a preference in what numbers (s)he would like to use. We do not allow duplicate numbers so please change the number of the ledgers already provided to the desired numbers and then add new ledgers. Ledgers are displayed in their nominals in numerical order.

In the first field you may enter a number. Feel free to make up a number. Your accountant probably has a preference in what numbers (s)he would like to use. We do not allow duplicate numbers so please change the number of the ledgers already provided to the desired numbers and then add new ledgers. Ledgers are displayed in their nominals in numerical order.