Depending on whether or not you allow it, clients can pay their invoices via a bank transfer. The moment the transaction is complete and the amount has been added to your bank account, you can process it in Animana manually. This article explains how to manually process bank payments in Animana.

Before you start

You need permission to be able to process bank payments. Permissions can de adjusted by practice administrators in ![]() > General settings > Role Management. “Financial – entry cash/bank” should be set to green. If you don’t have access to the general settings, please ask your administrator to check and, if necessary, make adjustments.

> General settings > Role Management. “Financial – entry cash/bank” should be set to green. If you don’t have access to the general settings, please ask your administrator to check and, if necessary, make adjustments.

Step-by-step instructions

- Go to

> Financial > Balance Cash / Bank.

> Financial > Balance Cash / Bank. - At the top, click the book year you want to add this transaction to.

- Scroll down to the bank book you want to add the transaction to, then click Add New Transaction behind it.

- On the left, you can search by client information (“client search”), invoice number, or invoice amount (open or total).

This is box titleNote that you can only use numbers in the field “invoice amount”. The field “client search” searches in the same way as the client search in the header bar. See the related articles for more information. - Click Search invoices.

- In the middle of the screen, you now see an overview of the invoices that match your search criteria. Click the blue arrow to the right of the invoice for which you are processing the payment.

- On the right-hand side, you can now enter the payment details for this invoice. Ensure that the date entered in the field “paid on” is the same as the payment date on the bank statement.

- The open amount of the selected invoice (now depicted in the list as bold and with a checkmark behind it) will be automatically filled in the “amount” field. Always double check the paid amount versus the amount that Animana shows in the amount field.

This is box titleIs the amount different? Read what to do here. - Enter the number of the bank statement in the box “No.”. This field is mandatory.

- Enter an additional “payment description” if required.

- Select whether or not to book the difference, if there is any. Read more about this.

- Make sure your name is entered under “Accepted by”.

- Click Save or Save and new payment if you want to add another payment for the bank book you selected in step 3 above.

More about this

How do I process payments that are not the exact invoice amount?

Should the client have transferred more than the invoice amount, you can enter the received amount in the box “Amount” and then check the box “Book difference” (step 11 above). After clicking Save, this will complete the invoice as fully paid and not leave a credit.

Should you want to leave the credit, then enter the amount but do not check the box “Book difference” before clicking Save.

Should the client make a partial payment and transfer less than the remaining invoice amount, enter the amount received in the box “Amount” and make sure that you do not check the box “Book difference” before clicking Save. This will leave an open amount on this client’s record.

Should the client make a payment that is less than the remaining invoice amount but the difference is only a few cents and you do not wish to follow up on this, you can check the box “Book difference” before clicking Save. This will make sure that the invoice is marked as fully paid and this client will not pop up in the debtors list with only a few cents left on the invoice.

When you tick the box “Book difference” amounts will be registered on ledger 4700 (Payment Differences).

Description of bank payments

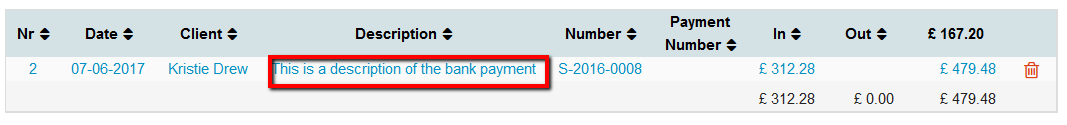

You can add a description to a bank payment while processing it. You can enter this information in the field “Payment description”. This description will be shown in the bank statement overview at the bottom of the screen.

Also, it will show on the “Payment Update” screen (Client file > open invoice by clicking on it > Payments tab).

Related articles

- How do I create an invoice

- How do I process payments while creating an invoice

- How do I process payments on existing invoices

- How do I process a payment against an existing credit or pre-payment?

- Balances (balancing bank statements)

- Ledger scheme

- Which specific fields are searched when I search for a client?