After a claim has been sent to an insurance company you may receive full or partial payment from the insurance company. This article explains best practices on how to book these payments and follow up on actual payments received from an insurance company.

Before you start

- An insurance claim must have been created (see Related articles)

- A preliminary payment must have been booked on the suspense account “Insurance Claims” (see Related articles).

- You need permission to be able to add payments and edit invoices. Permissions can be adjusted by practice administrators in

> General Settings > Role Management.

> General Settings > Role Management.

Step-by-step instructions

For the purpose of this article, we are using the following example,

- We have an invoice for £25,84 which we claimed with the insurance company Petplan, insurance claim number is CL-2021-0001.

- We have already booked a preliminary payment for the full amount on the suspense account “Insurance Claims”.

- The insurance company has decided to only pay £20,- on this claim by the bank on 09-02-2020.

- This will leave a balance of £5,84 to be paid by the client on 09-02-2020.

- Browse to

> Financial > Balance Cash/Bank.

> Financial > Balance Cash/Bank. - Click the current book year at the top of the page.

- Click Add new transaction behind “Bank” under the section “bankbooks”.

- Click Display Ledgers.

- Find the ledger “Insurance Claims” (you can use CTRL+F to search on the screen) and click on the blue arrow next to the direction “from”.

- On the right side, for “Paid on” enter the date you received the payment from the insurance company. In our example: 09-02-2020.

- Enter the amount you received from the insurance company. In our example: £20.

- For “no.” you can enter the the insurance claim number. In our example: CL-2021-0001.

- Enter a “payment description” if you want. For instance, you could mention that the claim amount was partially accepted (or full if the full amount was received).

- Make sure your name is selected under “accepted by”.

- Click Save.

By following the above steps, you will have booked the payment you received from the insurance company on this claim number. You do want the client file to show an open amount for the amount that has not been accepted by the insurance company. Read how to do this in our Related articles section below.

More about this

How do I check the transactions booked on an insurance claim?

- Go to

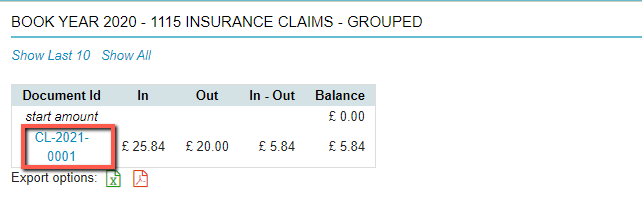

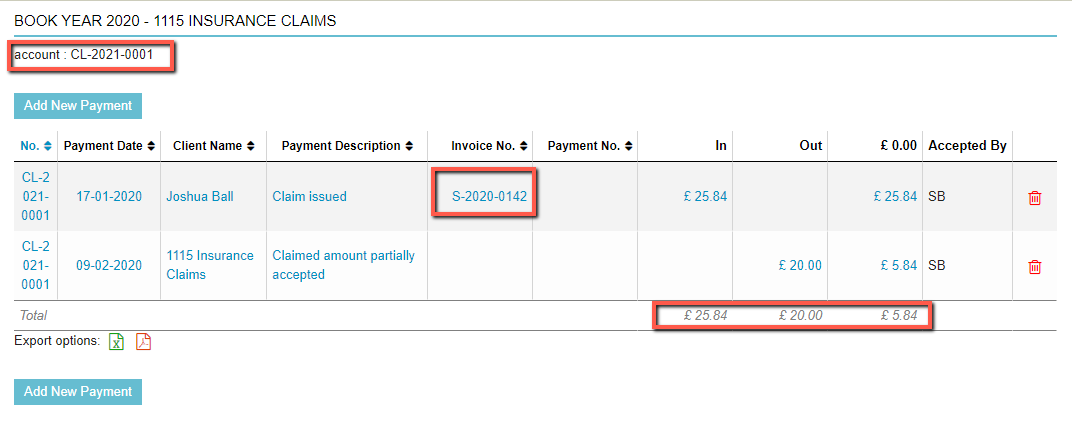

> Financial > Balance Cash/Bank > Insurance Claims > Grouped Per Bank Statement.

> Financial > Balance Cash/Bank > Insurance Claims > Grouped Per Bank Statement. - Following our example above, click CL-2021-0001.

This will show you the full report on all transactions booked on this claim number. Above reports shows that this claim is not balanced. The difference shown in the line total amounts to £ 5.84. The original Invoice this related to was number S-2020-0142 (as per this article’s example).

Above reports shows that this claim is not balanced. The difference shown in the line total amounts to £ 5.84. The original Invoice this related to was number S-2020-0142 (as per this article’s example).

Related articles

- How do I add a new transaction through Balances Cash/Bank?

- How do I add ledgers to my ledger scheme?

- How do I process bank payments?

- How do I view all Pet insurance claims?

- How do I create an e-Claim?

- How do I update the status of an invoice that was only partially covered by the insurance?

- How do I book a preliminary payment on suspense account Insurance Claims?

- How do I exclude an invoice from debtors?